Net nets

...and how to (still) bank on them.

Following my recent update on SunLink, readers have asked what I meant by the merger arbitrage investment being low risk because SunLink was a “net net,” likely to have been liquidated if not for the merger with Regional Health.

Therefore, this one will be about net nets and how to succeed with net net investing. Then, within the next few days, I'll send you a crisp new writeup on Deswell Industries, a net net.

Let me first explain what a net net is.

Imagine you own a widget factory. At the year's start, you got $10k of cash in your bank account, $10k of widgets produced and ready to sell, and $5k of receivables for widgets sold but not yet paid for. This means that, absent further business and after selling off your inventory, you're likely to have more than $25k of cash in the bank by year-end (since the inventory is sold at more than cost). Now, suppose you also owe $5k to suppliers for raw materials you haven't yet paid for and $10k to the bank for a loan. One day, a guy knocks on the door of your factory with an offer to buy your entire business — building, widgets, everything — for just $6k in cash. You do the math: after paying off $15k to the bank and suppliers, your $25k in liquid assets leaves you with at least $10k, and that's without counting the building or the future cash flows from operations. You'd probably shout, “Who do you think you are, lowballing me like that?”, and slam the door.

You'd think that selling your business with $10k in liquid assets, a building, and ongoing operations for a measly $6k seems absurd. But that's because you're dealing with an arm's-length private market transaction. In public markets, where chaos and inattention loom more frequently, transactions like these occur all the time, letting savvy investors grab stocks at discounts that would never happen in a private deal.

This is largely due to the question of control. If you buy an entire company, you control what happens to the assets. With an offer like the one above, you can always close down shop yourself and pocket higher, risk-less proceeds. In contrast, if you hold a minority stake in the company, you can't, since then you're at the mercy of the guy running the business or the controlling owner dictating the game plan. (I’ll cover other reasons stocks become net nets shortly.)

What I've explained so far is a net net. It's a stock where the company's net current asset value (NCAV) exceeds its market cap, and where the company, given its price, could be worth more to shareholders dead than alive:

Net net = market cap < NCAV

where:

NCAV = current assets - total liabilities and other senior claims

NCAV is not to be confused with net working capital (NWC), which is current assets (net of cash) minus current liabilities (net of debt). No, NCAV takes all current assets — typically cash, receivables, and inventory — and subtracts all liabilities, such as debt, payables, and accrued expenses, as well as other senior claims like preferred stock, non-controlling interests, contingent claims, other off-balance-sheet obligations, and outstanding options/warrants (which could turn in-the-money at the liquidation announcement). In other words, it's the bare-bones net value of the company's most liquid assets (and therefore excludes fixed assets that could also fetch a bonus in a liquidation) minus an all-in basket of whatever payments would come due before the shareholders get paid. It's an ultra-conservative lower-bound value, and any market price below this value is, in theory, bizarre. But as we'll soon learn, there can be method to the madness.

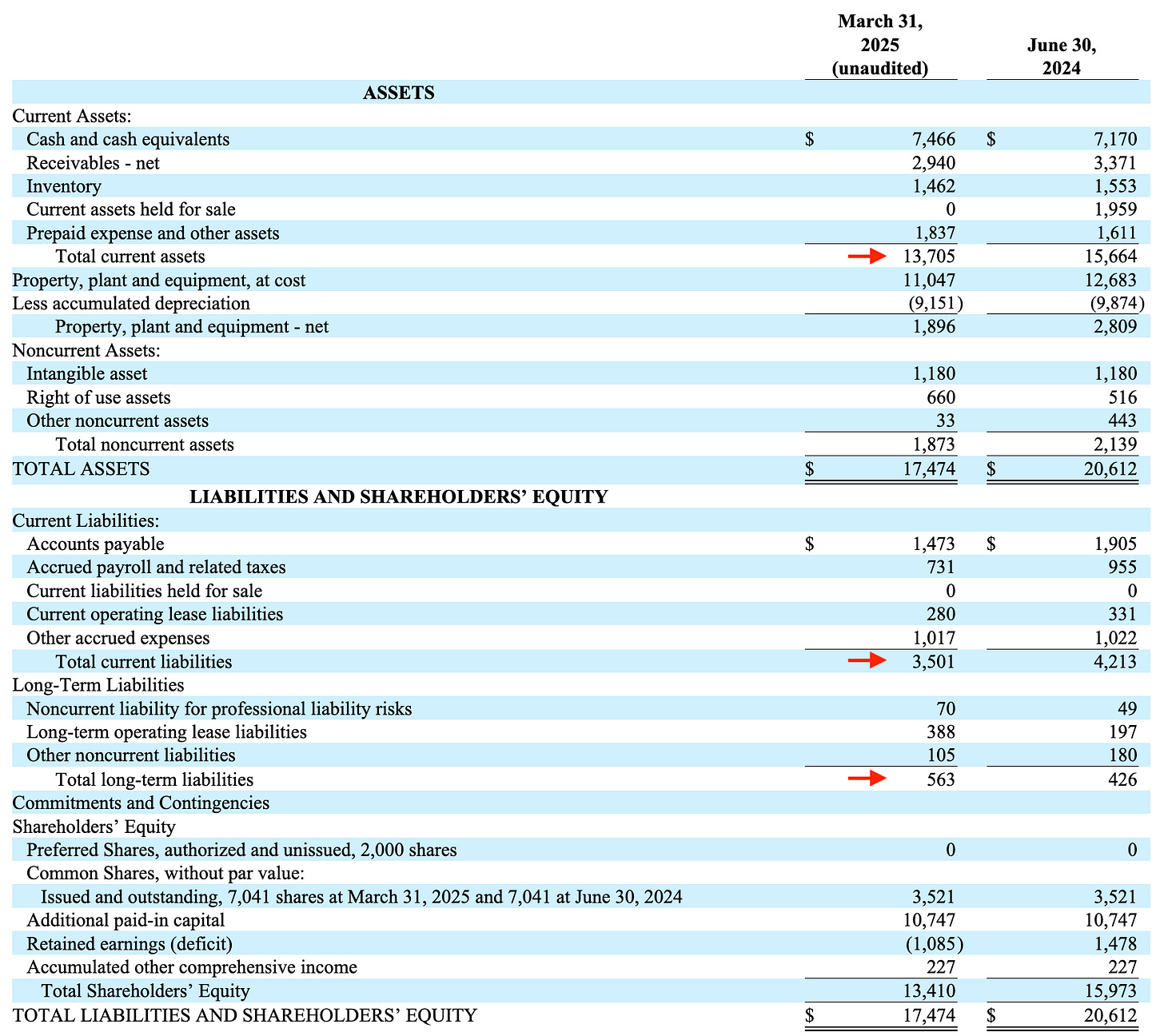

Instead of giving you a fictional example of what a net net looks like, I'm gonna use SunLink. Before the merger with Regional Health, this was its balance sheet as of Q12025:

Unlike the scenarios I'll walk through in a moment, SunLink’s balance sheet was simple. There were no senior claims ahead of the equity other than what was shown in liabilities, and the liabilities were straightforward. Most current assets were liquid cash, and SunLink had no funded debt. NCAV stood at $9.6mn ($13.7mn - $3.5mn - $0.6mn) against a $6.8mn market cap. If not for the merger, with just four pharmacy units, it could have liquidated quickly, and shareholders would have been able to realize something close to the NCAV.

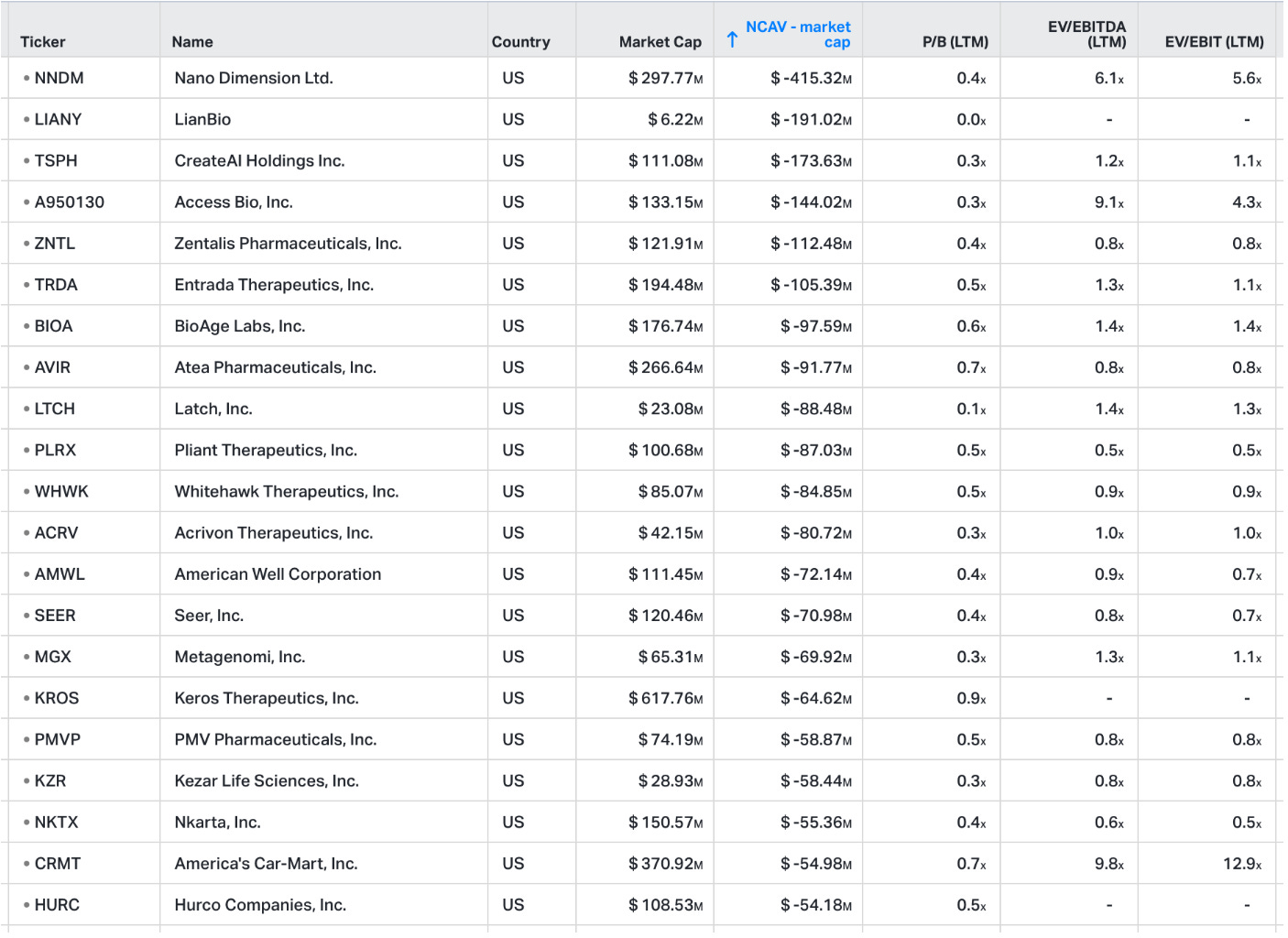

Here's the thing: SunLink was just a drop in the pond of net nets. Most people assume that ever since Ben Graham popularized net nets in Security Analysis, followed by Buffett, Schloss, Kahn, and others stacking up ungodly returns in the 1950s through the 1970s via net nets, the market has become smart enough for net nets to disappear, making their hunt futile and their returns a thing of the past. But they're mistaken. Net nets are more prevalent than you think. Right now, I count a full 140 stocks (excluding financial services, mortgage REITs, and real estate developers) in the US currently trading as net nets. There are ~130 in Europe. Both China and Japan have even more. India has ~30. This is a big universe to dig into, even in today's frothy market, where net nets should be scarce. Here's an extract of some current US-traded net nets:

So those who count net nets out haven't bothered looking. This is why net nets still work. In fact, net net investing is still likely the most durable, time-tested strategy to outperform the index over any 10-year period, powered by mean reversion as net nets boomerang back above their net current asset value (often via a buyout or corporate action; rarely do you buy a net net to see it actually liquidate). The most recent study I've found is this one from 1983–2008, showing that a portfolio of net nets would have returned 22.42% per year over the period. This one, examining stocks on the London Stock Exchange from 1981–2005, observed that a portfolio of net nets with an NCAV/market cap >1.5x would have delivered 19.7% per year. And this one claimed to backtest 32.83% per year from 1971–2007.

Yet, while it's hard to design a net net portfolio that underperforms the market over long periods, religiously sticking to the strategy is a whole other matter. The reason why it's so hard is that some net nets will turn out duds and others home runs. So it's not unlikely for an annual return distribution of a pure net net investment strategy to turn out like this:

Although your 10-year smoothed result from the return distribution above would have yielded a more-than-acceptable annualized return of 15% — ranking you in top 10% of all investors — it would be diabolically hard to stick to through a full decade.

This, of course, makes sense when you consider the composition of any random group of net nets. Companies don't turn net nets for nothing. And the concerns are often valid: Besides frequently being illiquid and uncovered, they can be terrible companies in terrible industries, have nosediving sales, and be run by management teams prone to destroying shareholder value. Past shareholders have lost hope or stopped caring. You won't find any net nets with durable competitive advantages or franchise value (so don't bother valuing the intangibles in liquidation). With moats, margins, and culture pounded into your head as table stakes for great investments, imagine how inconceivable it would be to continuously buy into such chaotic companies day in and day out. You watch Mag7, defense stocks, and hot new drug discoveries fly by in the news, you keep hearing new stick tips from friends and family, but you never flinch or stray from your goal. I know of no one who would adhere to such a system consistently, even as the returns offered are stellar. With net nets, you're buying trouble, but you're buying dirt-cheap trouble.

Even as there's generally nothing wrong with buying a basket of net nets and calling it a day, your goal in a net net investment — any investment, really — should be not to lose money. Net nets, by themselves, are no free lunch. Some things have to work in tandem for you to have a safe bet with an excellent return. Therefore, the question is what things to look for to stack the odds in your favor by picking the good net nets and disregarding the bad. This, by the way, is what Ben Graham taught all along: He never advocated buying all net nets but stressed that you "delimit the field of eligible investments" and then apply further selective processes to assess the safety of the asset, working upward from minimum standards rather than downward from some ideal but unacceptable level of protection. All the net net status signals is a potential margin of safety, protected by the liquidation (or "escape") value. Peter Cundill framed it like this:

"A share is cheap not because it has a low price earnings multiple, a juicy dividend yield, or a very high growth rate, all of which may often be desirable, but because analysis of the balance sheet reveals that its stock market price is below its liquidation value: its intrinsic worth as a business. This above all is what constitutes 'the margin of safety.'"

So it's up to your research to determine whether that margin exists. And the first step here is to recognize that NCAV does not equal actual liquidation value. NCAV is merely a proxy — a starting point.

There are three key dimensions to consider when assessing liquidation value:

1) Assets

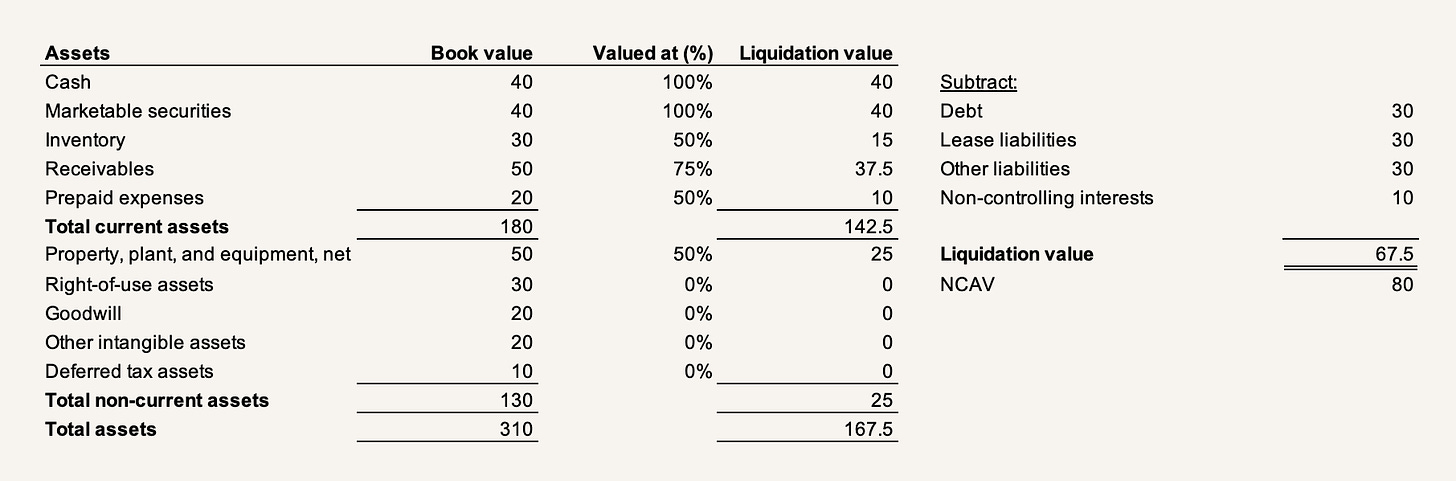

As Charlie Munger has said, "The liabilities are always 100%. It's the assets you have to worry about". Liquidation analysis is about using common sense.

Say you have a company with current assets that consist of zero cash, zero receivables, but a large pile of toy inventory. In that case, the current assets are likely to be heavily overstated. If the inventory consists of a single toy of a passing trend, it could be worthless in a liquidation, since no one would take it off your hands in a fire sale. (Think of fashion retailers with their 80% clearance window signs.) Conversely, if the current assets consist of 100% cash and marketable securities, you can usually count on that value as good to go (after you've deemed the company and its management to be no fraud and that the cash actually exists). Like inventory, receivables risk going unpaid. So you generally want your net nets to be heavier on cash and securities than on receivables and inventory.

Now, in another case, consider a company trading slightly below NCAV, but this company has significant fixed assets on the balance sheet that don't count in the NCAV formula. It has no leases (ROU assets) or leasehold improvements booked among those fixed assets, both of which would likely fetch nothing in a liquidation. What it does own, however, is a fully owned Class A office building fully leased to a Fortune 500 tenant, and the company could sell this building at or near its book value within 6-12 months just by phoning up a commercial brokerage firm. This would make the fixed asset — again, not part of NCAV — a much higher-quality and potentially more liquid asset than the toy company's inventory.

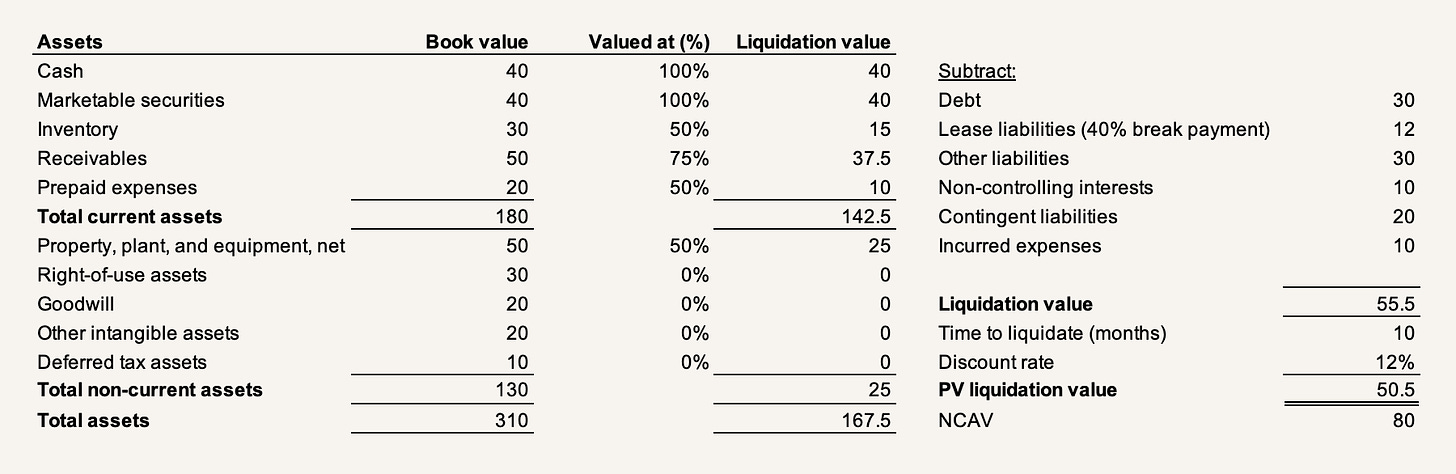

This means that, after digging into a net net, you gotta tweak the formula to get to actual liquidation value and evaluate each asset using common sense. In fact, an often-overlooked aspect of Ben Graham's teachings about net nets is that he often put safeguards in place, getting to a rough liquidation value by discounting receivables by some 25% and inventory by some 50%. By haircutting each asset individually, you might get a working liquidation balance sheet that looks like this (we'll continue tweaking this in the two other dimensions), so far reducing an NCAV of $80 to an actual liquidation value of $67.5:

2) Liabilities

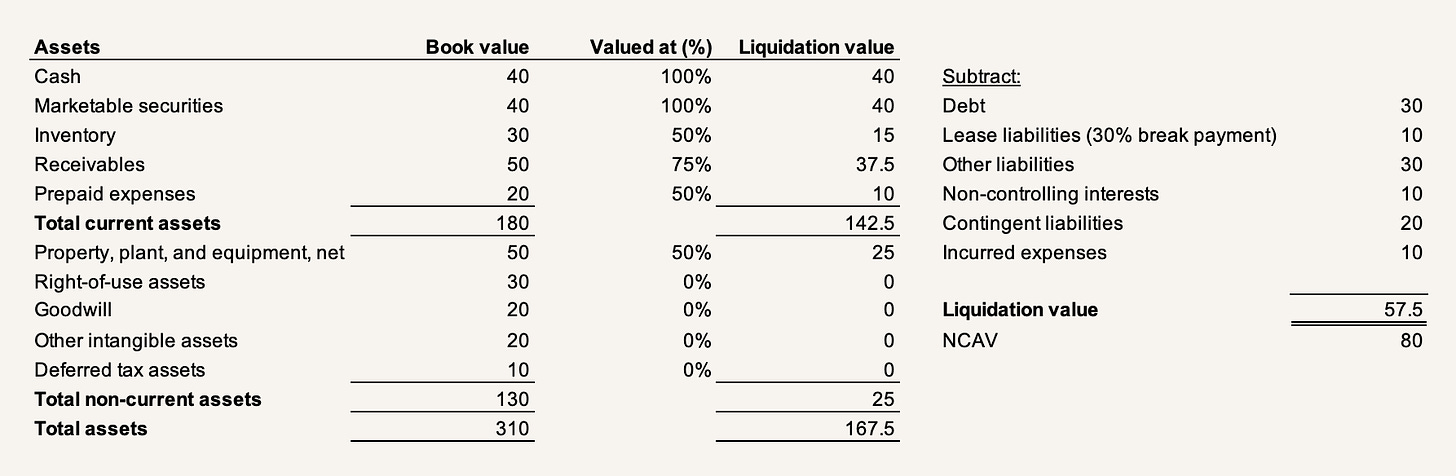

Even as the liabilities may be 100%, those 100% may be more than 100% of the liabilities you see on the balance sheet. (In less common scenarios, they can be less than 100% too if the company's debt is listed and trades below par.) Underestimating liabilities in a liquidation scenario is a real risk, as liquidations tend to unearth hidden or contingent liabilities ready to eat into what you think are your assets as a shareholder.

Several factors need to be considered here.

For one, not all off-balance sheet items may be provisioned. Contingencies such as pending litigation, regulatory fines, or product liability claims may be disclosed in the footnotes but not fully reserved as liabilities unless deemed probable and estimable under accounting standards (ASC 450 under US GAAP). In liquidation, these things can become immediate obligations as claimants press for settlements. Environmental liabilities, such as cleanup costs, can be another frequent surprise, particularly for industrials. Similarly, for consumer goods, manufacturing, or pharmaceuticals firms, warranties or recalls may be understated as liabilities, where a liquidation event could trigger a flood of unprovisioned claims as customers fear losing recourse.

Liquidations involve costs too, and you need to treat such costs as an extra liability. Selling assets isn't free, but incurs expenses related to auctions, brokers, legal fees, and administrative costs. If the company is heavy on staff, it may incur significant severance payments when laying them off, including accrued vacation and or other benefits, where those costs will only be partially covered in accrued liabilities. Especially for companies with long-serving employees or union agreements, severance payments tend to scale with tenure. Additionally, if the company has a defined benefit pension plan, it may carry deficits that are smoothed over in financials through actuarial assumptions, with any shortfall requiring funding.

And, of course, the largest trap is typically early termination of contracts, which is particularly relevant for retailers with multi-store leases. Remember that even as a company's lease assets (or ROU assets) would likely fetch nothing in a liquidation, the corresponding contractual liabilities persist and require break payments to exit. Obviously, break payments don't amount to the full liability, but could still amount to something like 30% of the total lease liabilities. This issue counts any complex outstanding hedges, swaps, or options too, which, although marked-to-market on the balance sheet, could trigger early termination clauses in liquidation.

The final aspect of liabilities is how much they lever your investment. Many people assume that net nets are inherently safe because you're safeguarded by "net worth". But your investment can still be highly levered if the liquidation stub is tiny relative to the liabilities. Liabilities create leverage, and leverage magnifies outcomes in both directions. Say a company has $100 in current assets and $90 in total liabilities, including all contingencies, leaving $10 in NCAV. This setup is levered 10-for-1. A mere 10% drop in current assets (say, $10, from inventory writedowns or bad receivables) would wipe out the entire NCAV. If the company is also bleeding cash and can't secure long-term financing, it's a death spiral. Now, if the company had no debt, and current assets still dropped 10% (to $90), you'd still have upside if you bought the stock at more than a 10% discount to NCAV.

With liability contingencies accounted for, you might now have a working liquidation balance sheet that looks like this, further reducing the original $80 NCAV to a $57.5 liquidation value:

3) Time

By now, you've learned that: 1) you have to be reasonably tough in evaluating net nets with significant non-cash assets, 2) your evaluation depends on the nature of those assets, and 3) you need to figure out whether to layer on extra liabilities beyond what's shown on the balance sheet. In other words, you usually gotta adjust the assets down and liabilities up, which may obliterate whatever liquidation value you thought was there.

In this third dimension of liquidation value — time — I'm gonna make net net investing even harder by arguing that you need to be skeptical about cash boxes (where the balance sheet is essentially all cash) too. The time dimension is often the most overlooked and detrimental aspect of net net investing. In fact, for the reasons that follow, likely just one out of every four or five net nets are really net nets if you take the time dimension seriously.

Most stocks become net nets because their value as going concerns dwindles with each passing quarter. As many of them are money-losing, by definition, their assets decrease and liabilities increase over time. Therefore, you must think like a bond investor aiming to protect your principal in a deeply discounted bond. As a bond investor, your number one concern — aside from the aspects we already discussed (such as the collateral, its quality, and the senior claimants ahead of it) — is interest coverage. A bond investor doesn't worry too much about what earnings are gonna be, but really cares about whether interest is covered. Similarly, as a net net investor, your number one concern is not necessarily to predict future earnings with accuracy, but whether the company has time against it from going bust. A long history of stable profits gives you the best sign of a margin of safety.

Another often-overlooked aspect is the time it would take to liquidate. If a company has operating assets/liabilities, it doesn't liquidate from one day to the next. The company will need time to collect payments and liquidate inventory and fixed assets. And if regulatory processes are involved, this process could drag out beyond a year. So the dollar you expect today will need to be discounted by your risk-adjusted opportunity cost.

Lastly, we return to what I mentioned at the beginning of this note: the control factor. As a net net investor in public markets, unless you buy a controlling stake in the company, you're at the mercy of its insiders. And as always, incentives can trump everything else. This is the number one reason stocks become net nets, and you must take it seriously.

Because in some cases, even cash is not 100%. What a company's cash is worth to you as a shareholder entirely depends on what insiders intend to do with it. One thing you likely noticed from the screen I showed earlier is how “busted” biotech stocks dominate the list. Some of these are pure cash boxes with minimal operations, and they're naturally cash-rich because they just raised the cash but fully intend to burn it until they find a breakthrough discovery. It's the same principle with mineral exploration companies. You should avoid such companies because the market already recognizes there'll never be a natural rebound in the business to recover its liquidation value. That's why you often see busted biotechs trading at negative enterprise values.

But there are other scenarios where cash is not 100%. One of them ties into the time it takes for a company to liquidate. For instance, when a company receives prepayments for deferred revenue (like subscriptions or services to be delivered later), that cash is restricted in the sense that it corresponds to a future obligation. Consequently, it's not freely available, as the company must still deliver goods or services to "earn" it. And since the company incurs operating expenses to deliver those goods and services, not only is the cash to be "earned" sometime in the future, but it's also not 100%. Of course, in cases where the contract is non-binding and the company liquidates quickly, the deferred revenue (a liability on the balance sheet) will offset refunds, and NCAV already accounts for the obligation (since you already subtracted all liabilities). However, enterprise value doesn't, so you can easily be fooled by a company that appears to trade below “net cash” if you rely solely on enterprise value.

Lastly, you can have insiders that 1) are fraudsters or 2) hoard cash and never intend to liquidate or give it back to shareholders. Guess what the cash will be worth to you then? Or, say you have a company with no earnings and a big pile of cash that you know insiders will drip out to shareholders slowly over many years as dividends. In this scenario, of course, you wouldn't treat those dividends (or cash flows to equity) no differently than cash flows from operations, meaning you must discount the whole cash pile by the time period over which you expect to receive the cash. Moreover, if insiders are saving up cash for a big, foolish acquisition, you may need to discount it even further to account for that risk.

So while NCAV is an easy-to-calculate number as a liquidation proxy, a more realistic liquidation incorporating the insights we've discussed so far may look something like this, reducing what looked like a margin of safety to just about nothing if buying the stock at 60% of NCAV:

While another net net where everything falls into place can look like this, fetching more than NCAV in a liquidation scenario:

These are the key lessons to take away:

Only a fraction of the net nets you see out there is investable, as apparent liquidation value is fleeting for most of them. Accounting is nothing more than a language, and interpreting financial statements is an art because precision is unattainable. That said, never make the mistake of not reading the fine print in the footnotes.

The best net nets are those where the underpricing stems from external factors rather than internal issues tied to management actions. The best net nets are when you lean into chaos. Many investors overemphasize how much you need a differentiated view and to be a deep thinker in investing. Many net nets are simply supply and demand imbalances, where some of the guys on the other side of the trade already know you're getting a good deal.

Don't get too fixated on the balance sheet when the operating business, profitability, reliability, and safety are more critical. A long period of consistent profitability, combined with a low earnings multiple, is preferred. It's good practice to plot how NCAV or liquidation value has trended over time, rather than just looking at the current snapshot. High or even satisfactory returns on capital don't matter, as you want the company to preserve and pay out its capital, not necessarily grow it.

Of current assets, prefer cash to receivables and receivables to inventory. But recognize that even though cash is the easiest to value, it may not be 100% and may need to be discounted.

Generally stay away from biotechs, mineral exploration firms, real estate developers, and financial services posing as net nets. Also avoid business models you don't understand. If the business description is filled with buzzwords, steer clear.

Alignment with insiders matters — a lot. Perhaps counterintuitively, as insiders scare people, the best net nets are those that are family-controlled rather than those with high institutional ownership. Significant insider ownership reduces the risk of dilution, reckless spending, or crowded trades.

The more levered a net net is, the more risk you take on whether your assessment of the assets and liabilities is correct. Leverage magnifies outcomes, good or bad. A net net is by definition already incredibly cheap, so you don't need leverage or the extra risk. Focus on net nets with little to no debt (anything <35% debt-to-equity is worth looking at) so you get some leeway for errors in your analysis (a margin of safety on yourself, if you will).

Catalysts are preferred, whether it be buybacks, announced or increased dividends, pending buyout offers, or actual liquidations. Insider buys are great too. Remember, the purpose of investing in net nets is not really to have the company liquidate, but without a catalyst, you risk a multi-year-long share price stagnation (depending on where operations are trending) if no one wakes up to crystallize the value.

A lot of people consider value investing, and thus net net investing, dull — like watching paint dry — and are more easily caught up chasing growth stocks, while thinking that value investors hug the safe side of the road. This is only half-true. Net nets can undoubtedly deliver outsized returns, but holding (ostensibly) deeply discounted stocks, like those trading at 60% of NCAV, carries real risks of nursing opportunity costs for years if those stocks turn out duds or erode value. Growth investors face different risks, mostly with no margin of safety to catch them. Either could be regarded as gambling or calculated risk-taking. Which one it is, however, depends on the meticulousness of the homework.

Keep an eye out for my email on Deswell Industries in the coming days. This one has many of the attributes we talked about today: it's an easy-to-understand business, consistently generates profits, boasts a high family ownership with a comforting background, has paid a dividend every year for nearly 30 years, and is incentivized to keep paying them. Furthermore, the share price has been on the move since mid-June. But there's still some hair on it, which I spell out in the writeup. Subscribe below if you haven't already to access my research archive and future research. I'm grateful to have you along for the ride!

Oliver Sung is the founder of Sung Capital. Sung Capital picks underpriced stocks, usually in pockets of the market where large pools of capital (funds and institutions) can’t or won’t invest. Sung Capital picks stocks only, uses no leverage, and requires a significant margin of safety in every investment. Oliver can be reached at oliver@sungcap.com.

Thank you very much for this perfect write-up Oliver! It was really great to read all aspects of net net investing as you have put them clearly.

I have a question regarding the part you explaining that not every cash is valued at 100%. I totally agree with that. I think we should factor out the cash amount requiring to sustain business operations. So, net net investors can focus more on “excess cash”, which is ready for distribution to shareholder, therefore can lead value to be realized. So, higher the excess cash, higher the possibility of catalyst being in place for that stock. My question is that how do you calculate cash needed for business operations and so excess cash? Do you have an approach or formulation for that or you use some common assumption like “cash requiring for business operations as 3-5% of the revenue”?

I really like the way you give the detailed method to approach net-nets. I do think you provide one of the most important key deciders: "In contrast, if you hold a minority stake in the company, you can't, since then you're at the mercy of the guy running the business or the controlling owner dictating the game plan".

This resonates with my thought and experience too. I'm also curious if you’ve been looking at how net-nets behaves globally?